While light novels work a bit differently from manga in several key ways (stronger second-week showings, lower thresholds, etc.), they similarly often see big boosts after and presumably due to from anime adaptations. I collected the light novel sales history of the series to get anime adaptations in 2013 on this doc, and plotted them on the charts below, to illustrate which series did and didn’t get visible boosts.

This post doesn’t cover series with no post-airing releases (Maoyu, Uchoten Kazoku) or no pre-airing releases (Free/High Speed).

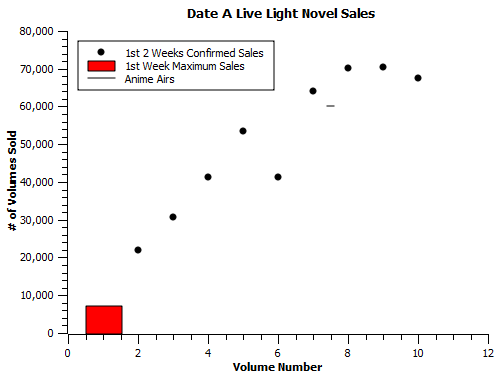

Date A Live

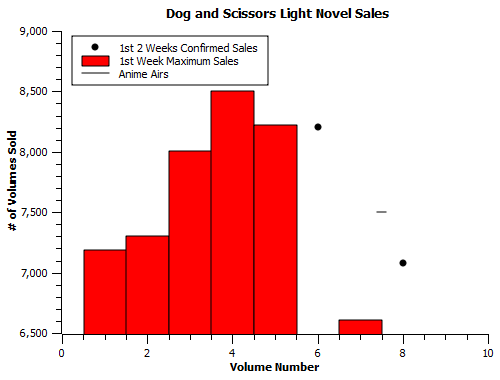

Dog and Scissors

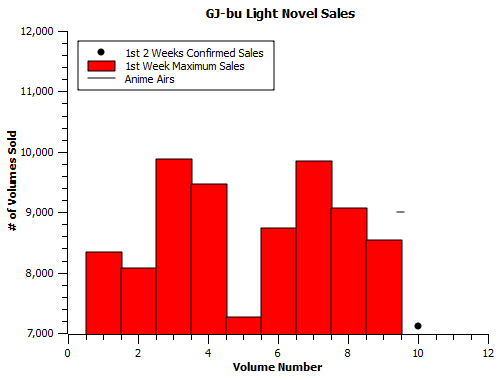

GJ-bu

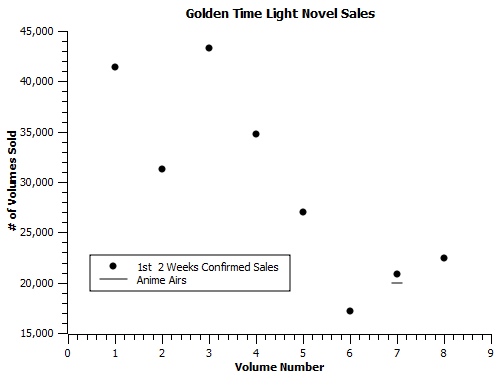

Golden Time

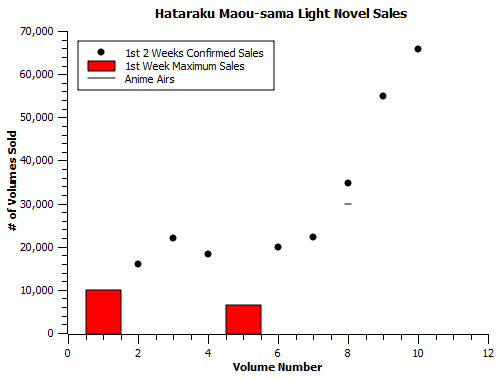

Hataraku Maou-sama

Henneko

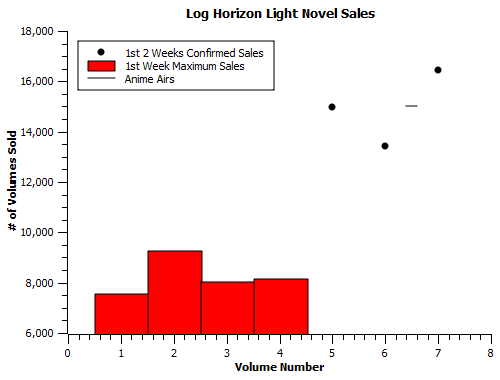

Log Horizon

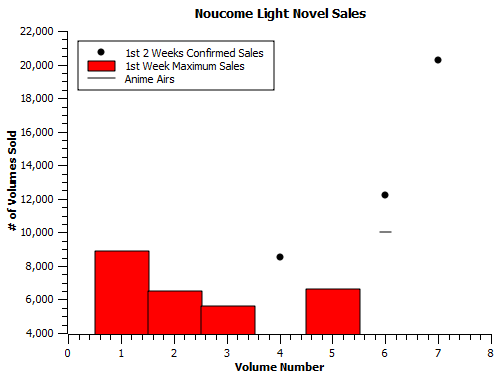

Noucome

OreGaIru

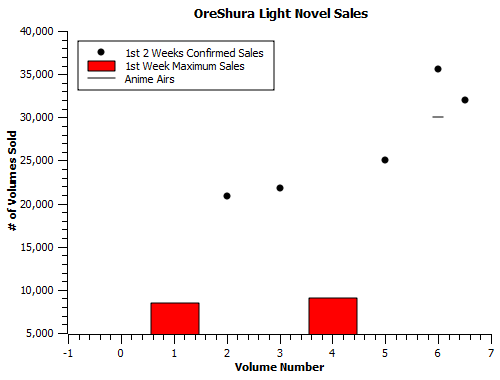

OreShura

Outbreak Company

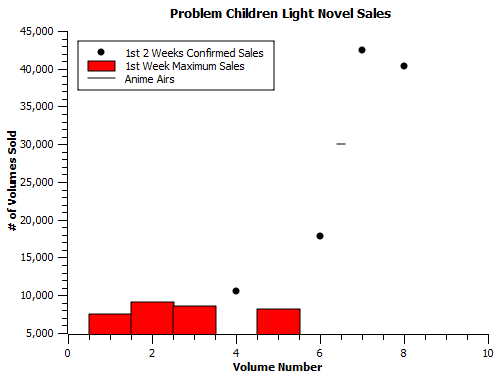

Problem Children

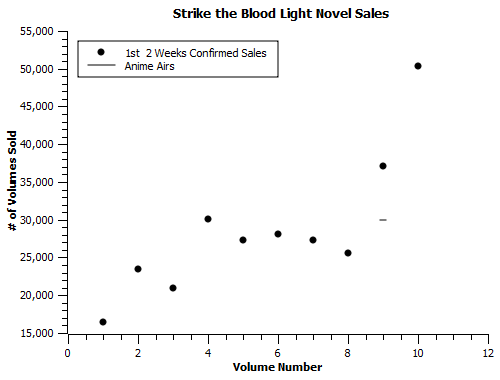

Strike the Blood

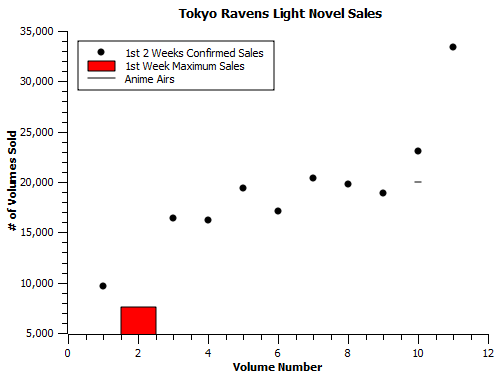

Tokyo Ravens

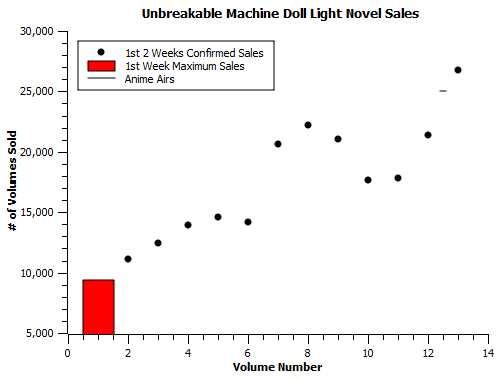

Unbreakable Machine Doll

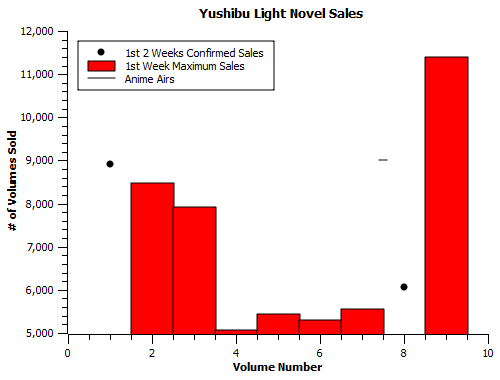

Yushibu

The following series were excluded due to lack of any chart appearances, despite having volumes released both before and after their anime adaptations aired:

Brothers Conflict

Kyoukai no Kanata

Sasami-san @ Ganbaranai

Sunday Without God

Some Observations:

-Some series have odd below-threshold releases among generally high totals. I’d presume that’s noise due to unfavorable splits, rather than a real decrease in sales of that volume. Those become less of an issue when you have several volumes worth of data.

-A lot of series with middling disk totals (Tokyo Ravens, Problem Children, Noucome, possibly Outbreak Company) presided over decent-sized boosts, though by far the biggest boost was Hataraku Maou-sama’s. Substantial sales boosts were fairly common.

-Date A Live stands out as a series where very good disk sales seemingly didn’t translate to any big rise in LN sales. This is a bit of a trick of airdates; volume 7, the first to top 60k, was released slightly after the mid-March preairing of the series, but before the TV broadcast, so it very possibly played a role in the higher sales from 7 onward.

-Golden Time was on the decline, and while it wasn’t a poor-performing light novel by any stretch, the anime’s failure to produce any tangible benefit does lend some credence to the idea that it’s harder to get disk sales or boosts out of series slightly past their prime.

From the charts, I think obviously hyped anime series will bring the light novel figures up, and not hyped series will not affect the novel sales as much, though how to define “hype” is another question.

Defs depends what sense of hype is meant. There’s always lots of small-scale website polls out there that give snapshots into what some people are anticipating, but you’d have to parse out how representative they were (gotta have something both large and surveying the people you want to know about) as well as how well they conformed to expectations. There was a poll for Fall 2013 that cited Gingitsune as the most anticipated series, which doesn’t seem plausible based on its manga totals.

I do tend to find that existing LN bases (via sales numbers) definitely mattered more than manga ones for their anime counterparts over the past several years, at least.

Yes, I wouldn’t trust small-sample polls either. I do realize the definition of hype is vague, but it could mean for example “top-trended anime on twitter”, “popular anime on MAL entries” etc., even though they are quite flawed. And I don’t really mean hype as in the anticipation before the series, but rather how much popularity it gains after it finishes airing. With the exception of Golden Time,

I guess what I am trying to say is that being as immersed in anime as I am, I am not surprised at any table. Without exception, anime that are badly adapted or I haven’t heard of experienced a drop in source material, and anime that are well adapted give rise to a boost in source materials. Granted, a lot other factors could affect the sales…

(Think you accidentally cut a line or two out of your post in the Golden Time bit)

There are reasons why that sort of individual insight is useful; you can’t easily put out a number or statline that accurately measures the quality of adaptation.

Whether it’s a shameless lazy panel-for-panel rip or one with a lot of visible effort, it’s a product with a lot of moving parts that’s made by a 100+ person staff.

That said, I’m skeptical as a rule about relying on expert/eye-test testimony to judge a show, either my own or anyone elses. There’s merit in discussing those things, but the “why” factor is complicated and likely not the same for everyone. For example, I’ve seen many, many differing opinions pitched on why the recent chuu2koi sequel experienced an above-average dropoff. I’ve seen it argued in separate circles that there was too much romance, not enough romance, too little of a given character, or that the comedy just wasn’t as funny any more. All have some merit as explanations, but there’s not one definitive reason. Ask 10 random people why a show failed and you’ll often get 10 different answers (2 or 3 would likely argue that it did everything fine), which is why I personally don’t like to exaggerate the importance of my judgement when I’m really just one of those ten.

Good to see that, though Tokyo Ravens flopped, it at least boosted sales by a lot, but we won’t really know the full, long-term effects of the anime until maybe October. Still, are its new sales numbers (~33k) pretty good for an LN? DAL (as you mentioned) is also a rather interesting case, though the light novels were already relatively popular before the anime, so those figures are still respectable. As for Golden Time… poor poor Golden Time, its performance isn’t looking Golden at all.

Log Horizon has relatively low sales for an LN, but the anime isn’t a flop (and in fact could be considered a modest success) since NHK shows rely more on ratings, and LH has pretty good sales for an NHK show. Another weird case is HenNeko: the anime sold pretty well, but sales actually declined after the series aired. And finally, I get to Oregairu. The anime flopped. And it appears sales weren’t affected much either. Ouch.

Finally,when you mean “The following series were excluded due to lack of any chart appearances”, does that mean that Sasami-never charted even after the anime aired?

I don’t have a good grasp of all the economics involved, but I’m fairly sure that 30k+ is a good enough total to let the series run effectively forever if the author feels like it. If it ran for 5 more volumes, it’d be generating a minimum gross profit of 30,000,000 yen (not counting EX in nest or long tails).

Sasami-san never charted; v11 came out in June of this year, and could have charted with a 7k week. As always, no idea what tail, if any, it had.

I’m not sure which flop series you’re talking about, but it’s not Oregairu. 9.7k average and a 60k+ print volumes bump is something I’d take for any series, period.

Oops, I meant Oreshura, not Oregairu. Had not been thinking properly because of the news that ClariS is disbanding.

I meant to say Oreshura. What can you say about Oreshura’s sales and boost (or lack thereof?)

OreShura has a 3.8k disk average and a 10k+ print volumes boost. That’s not super-sexy, but it’s definitely respectable and probably just fine with the makers.

33k sales in 2 weeks is great. You’ve got to bear in mind a couple of things:

– As is sort of pointed out in the article, the majority of a LN’s sales will come from its long tail, well after the first two weeks. The same is true for manga. This is particularly true for series that are growing in popularity, or that have been running for more than just a handful of volumes (as a series progresses, people fall behind the releases). Which means pretty much everything. A typical figure for a series with an established fanbase and nothing to generate a boost seems to be about 30-45% increase over sales at the end of week 2 by 6 months after release date. And it would, of course, continue to sell beyond that as well.

– A lot of sales come from retailers that do not report to oricon. For example, aside from a couple of bulk orders from amazon a couple of years ago every single manga or light novel volume I have ever bought has not been from a retailer that counts towards the sales figures. Again, this is more true for light novels than it is for anime. There’s no actual figures for this, unfortunately, but I wouldn’t be surprised if barely half the actual sales were reported to oricon. For series such as the mentioned Kyoukai no Kanata, this % would be far higher, as KyoAni’s light novel label does not sell through most retailers, and their own shop (where the vast majority of sales would thus come from) does not report to oricon.

Sorry if this is a relatively late reply. But this line you mentioned is rather interesting.

“KyoAni’s light novel label does not sell through most retailers, and their own shop (where the vast majority of sales would thus come from) does not report to oricon.”

Is it possible that KyoAni is deliberately giving their LNs relatively limited releases (I read somewhere that many of their LNs, including Chuu2, couldn’t even be found in places where you’d normally see other LNs) so that the sales of their LNs can’t be tracked (since KyoAni shop doesn’t report to Oricon)? Or do they believe their LNs are so niche so they don’t find it viable to have wider releases?

It’s theoretically possible they would be trying to keep off the charts, but I don’t see any particular reason why they would do that (let alone deliberately try to sell less). More likely the Oricon charts aren’t a big deal for them either way, and they prefer making their sales directly rather than through middlemen, sidestepping that annoying retailer cut. Also, if they’re trying to stay off them for some weird reason, they already failed; High Speed! sold 22k copies on the Oricon charts last July. I think it’s much more plausible that they just have less experience managing their brands in that medium.

I heard rumors though (reliability unknown) that KyoAni might not be in good financial standing lately (reportedly because KyoAni is said to generally have higher production values than most anime studios, so the threshold for success is higher.), although given the success of Free, this is most likely trolling and/or misinformation. Still, Tamako Love Story not doing especially well at the box office, Kyoukai no Kanata only being a modest success at best, Chuu2 Ren having a massive drop in sales, and finally the uphill battle (actually up-mountain) that ABP will be facing sales wise, it seems that the days of post-Haruhi KyoAni anime being sure successes (except Nichijou) is over.

What you’re talking about are really two separate things; 1) Is KyoAni potentially in dire straits financially?, and 2) Are they done being sure successes?

To answer the second one first, they never were a sure bet, just a good one. Beyond Nichijou, there was also the 2009 Munto TV series which didn’t sell well enough to chart. Leaving aside the much-discussed tweet by animator Suzuki Shunji (a Gainax guy who’s never worked at KyoAni), we don’t have real evidence that production companies or the studio itself ever held the view that everything they contracted out to KyoAni would be a hit. They work on the business side, and presumably prepare for uncertainty. What did happen is they had a fantastic run involving Lucky Star and Kon becoming huge out-of-nowhere hits. It’s an impressive stretch, but not one that would necessarily scream “invincible” to people who make the decision to back their shows.

The answer to the first question is a tad more uncertain, mainly because we have no idea what budget went into these past couple of projects. If I knew quantitatively how much more an average KyoAni show cost, I’d be more willing to make a judgement. More speculatively, Free does figure heavily into the calculus here. Even if you do assume that their shows need a 6k average to be successful (as opposed to 3-4k normally), you can split up that 29k average 4 ways (accounting for it, Tamako, KnK, and chuu2koi2) and still come away with 7k per show before counting the other three’s averages. If Endless Summer does below 6k, then we can talk trouble. AmaBri isn’t an issue for them financially; Kadokawa’s paying for it, so they’re the ones shouldering the risk.

Also, calling 120 million yen gross *anything* for Tamako Love Story in particular seems premature; we still haven’t seen disk sales totals, and it outdid a number of movies of shows with higher averages. It’s at least plausible that there were lower expectations and hence lower budget make that a palatable number.