The commercial impact of anime goes well beyond its disk sales. Manga may sell to more people, but anime is extremely visible, airing on TV (albeit often late at night) and propagating around the internet at a very rapid pace. This visibility very often can lead to an increased strength of the franchise in general, propping up sales of print material, figures, and any various other related goods. Sometimes, anyway. 2013 was no exception, and saw a number of manga adaptations have anywhere from minimal to explosive effects on the sales of their source material.

I collected the manga sales history, including thresholds for series which charted sporadically, on this doc, and plotted it below. Note that these sales are not total, but the total number reported in a roughly fixed time period. Comparing sales tail length is a whole other issue, and I’m trying as much as possible to compare like figures.

One important difference from similar breakdowns of 2011/2012 series is that here I’ve opted to use the total sales from a series’ first 2 weeks of release (the highest reported total in that time interval), to attempt to minimize the effects of a bad split in creating artificial variations. It’s still an issue either way, but the difference between 9 and 14 days is a lot less than the difference between 2 and 7 days.

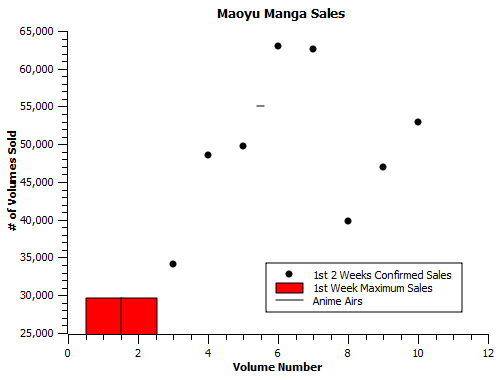

Two important series-specific notes prior to the plots. First, Maoyu is plotted here, in the manga section, because the manga charts more consistently than the light novel did and, more importantly, has available data from both before and after the anime aired (the LN ended just prior to 2013). Second, I can’t parse impact for series that don’t have at least one volume which released after the anime began to air. I thus will not be covering Servant x Service here, though there is data available. I will cover it in an addendum post come September when volume 4 has been out for 2 weeks.

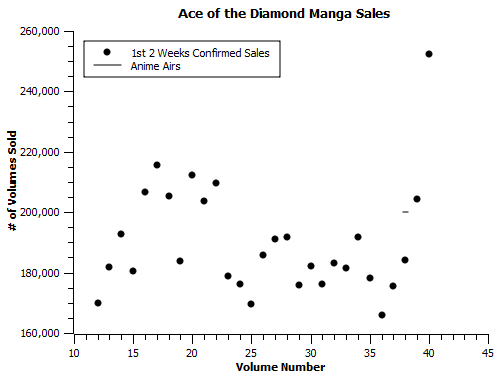

Ace of the Diamond

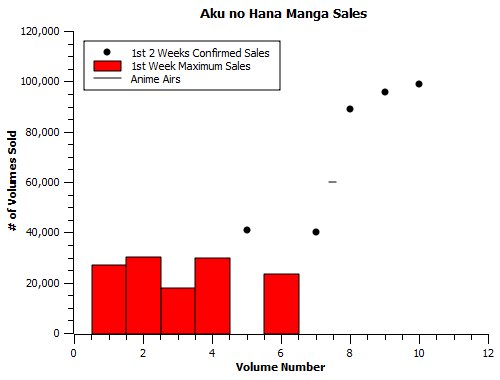

Aku no Hana

Arata Kangatari

Arpeggio of Blue Steel

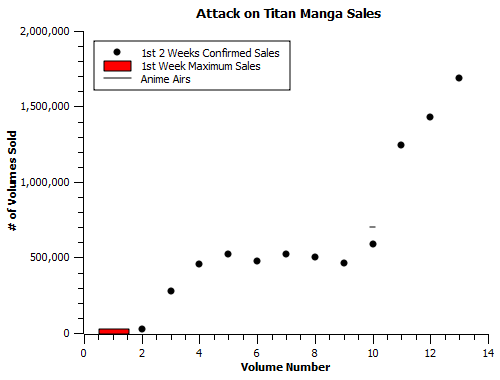

Attack on Titan

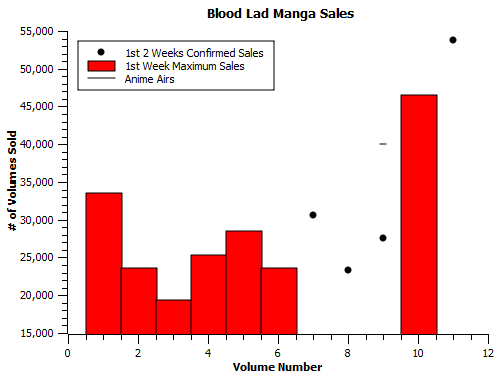

Blood Lad

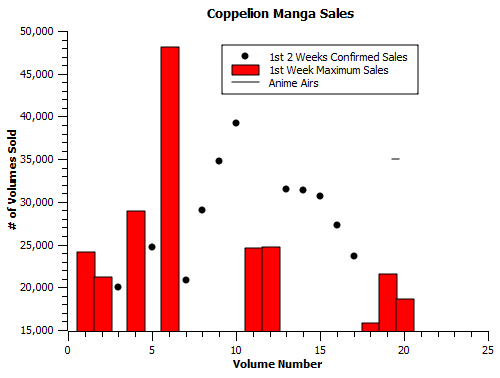

Coppelion

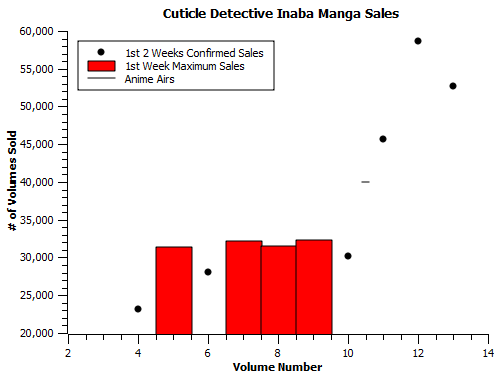

Cuticle Detective Inaba

Gifu Dodo

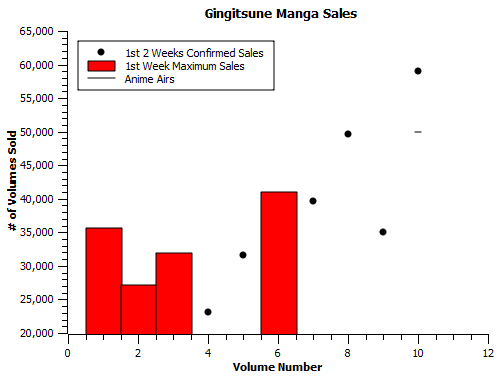

Gingitsune

Hakkenden

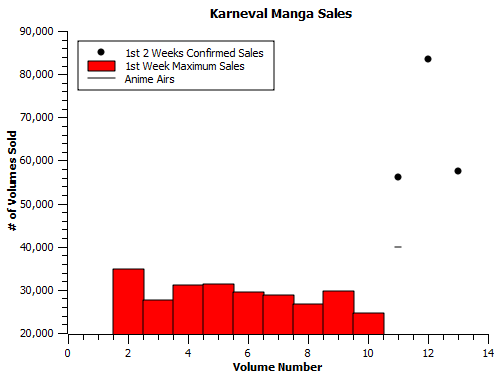

Karneval

Kimi no Iru Machi

Maoyu

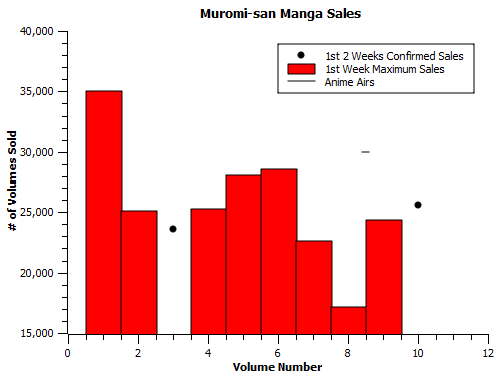

Muromi-san

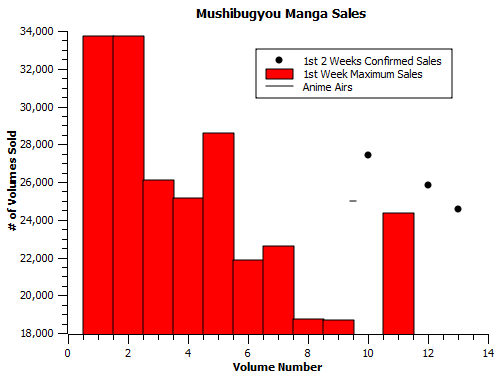

Mushibugyou

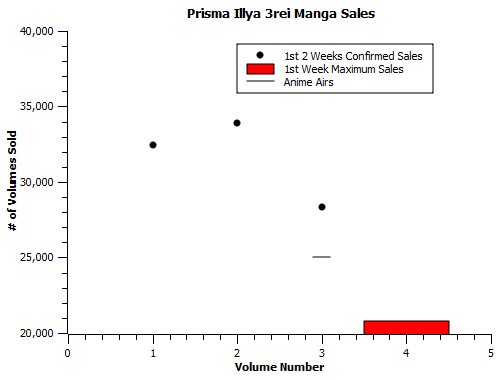

Prisma Illya

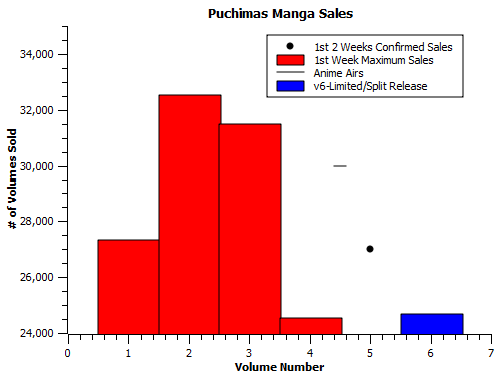

Puchimas

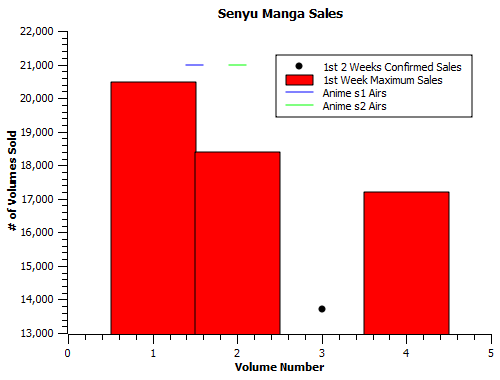

Senyu

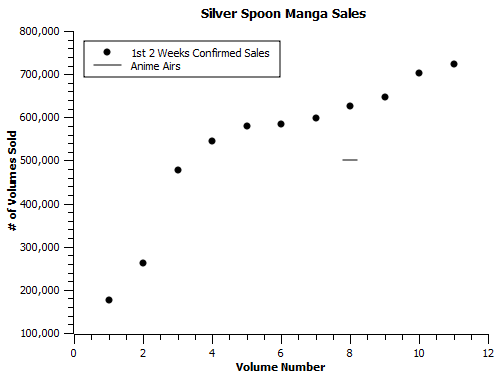

Silver Spoon

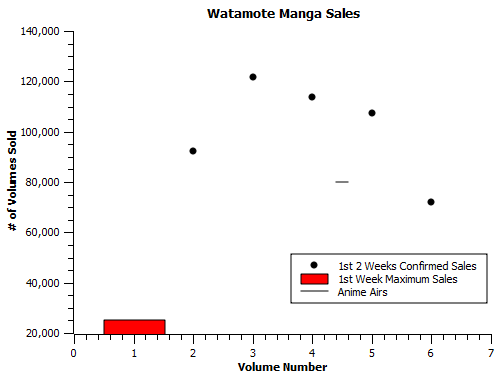

Watamote

Yowamushi Pedal

Series that haven’t chart period, thus not having info available to plot (this does not necessarily mean they didn’t get a boost):

Ai Mai Mii

Aiura

C3-bu

Dansai Bunri no Crime Edge

Go-Home Club

Kiniro Mosaic

Kotoura-san

Love Lab

Makai Ouji

Mangirl

Non Non Biyori

SekaiTsuyo

Yama no Susume

Yuyushiki

Some Observations:

-“Everybody’s third choice” might be too simple a way to describe Watamote. It put up great numbers across the board in almost every indicator, but failed to produce any sort of tangible commercial benefit. With disks, that can be explained away by other things (Titan/Monogatari/etc.) taking a higher priority with people who liked the series. But that same cost wall effectively doesn’t exist for manga. My best guess? The anime’s broad base of support came near-exclusively from existing manga fans who either weren’t disk buyers or had other priorities at the time. Ditto for Prisma Illya, with the all-important caveat that the disk buyers showed up for that one.

-I really can’t wait for the volume 9 data (due out in June) for Arpeggio. It put up numbers well in excess of volume 7’s threshold in the first month of the anime’s existence. It’s been quite common for what eventually became very substantial boosts into the 100k stratosphere to be basically invisible at that point. I’m presently trying to talk myself out of 80,000 volumes in 2 weeks as an acceptable target figure.

-Silver Spoon is kind of a tough call. Sales before the anime are slightly greater than they were after, but just based on those figures, it’s not easy to rule out splits/limited edition contents/word of mouth as bigger factors than the anime (though it was almost certainly *a* factor).

-Puchimas’ v5 first-time chart at first appears to be a blip, but v6 had separate oad bundled* and non-oad editions, splitting the numbers of a series that probably would have passed the threshold combined. Can’t complain, though; Takane, Miurasan, and a kotatsu versus the world was worth every penny.

-Similar limited/regular edition issues for Blood Lad, with the wrinkle that those two versions of v10 were released in separate weeks. v11, at least, made the boost obvious.

-Attack on Titan obviously is putting up monster numbers, but that’s kinda the case on both sides of the anime; the post-airing numbers are just kooky.

-Gifu Dodo, Arata Kangatari, and Coppelion all seem like poorly timed adaptations, coming after a series declined from a clear peak figure. Those didn’t do well, but Ace of the Diamond, which was coming down less hard from its peak in 2010, got a fairly strong showing from its post-anime volumes.

-It’s nice to see some series with notable detractors and middling-to-poor disk numbers get manga boosts (even if I’m sometimes one of the detractors). Good showings by Maoyu, Cuticle Detective Inaba, and Aku no Hana.

-Speaking of which, I regret that I wrote a piece on the manga sales impact of Aku no Hana thinking 9 was the last volume. Having an extra volume sell a minimum of 50,000 extra copies moves the needle a bit more in the neutral direction. Then again, disk sales averaged about 300 (not just sub-1000), so it’s more likely than not a wash based on what’s been charting. It’d be nice to have printrun data for the series in addition to Oricon chart data – might give an idea of how long the tail is and allow further analysis. Maybe, anyway.

So… the Arata Katanagatari anime can be considered a total flop?

Also, about Blood Lad. I know the anime tanked so badly it didn’t even chart, but what can you say about its boost? Doesn’t seem to be big to me. Also, it seems Coppelion actually sold worse after the anime aired. What can you say about this? I see you made some comments already in the post but a longer analysis is appreciated.

I don’t see any evidence that would make me label Arata as a non-flop, and it runs in Weekly Shonen Sunday, where the bigger reader base (at 500,000 in circulation even now) means expectations should be higher than what it’s been putting up even while charting.

I’d totally take that Blood Lad boost 8 or 9 times out of ten, though. 55k post anime from 30k pre is a pretty big change, especially if it gets the kind of casual attention that gives it a bit of a tail. It also runs in Young Ace, which is a much less prestigious publication than the big three shonen mags. I don’t have circulation numbers for it, but other Kadokawa serials that aren’t Gundam Ace have circ numbers in the 60-30k range:

Shonen Ace = 60,667

Dragon Age = 28,334

Gundam Ace = 113,000

Asuka = 27,334

Ciel = 36,000

(from http://mangahelpers.com/forum/showthread.php/52966-Magazine-Sales/page5 )

There’s a good chance it’s selling more tanks than its magazine is selling copies, which is a pretty good benchmark to have. I’d like to have an extra vol worth of data to be sure (v10 splits are weird), but I’m reasonably ok with the idea that that’s a number Kadokawa’s happy with.

Coppelion is a many-headed monster, but I think 2-3 aspects of the situation stand out. First, I’ve noticed that boosts often take more time to set in for longer (i.e. 10+ volume) series than for shorter ones, and Coppelion was pushing 20 before the anime. Also, the anime was planned and produced before the Tsunami and shitty stuff that happened as a result. The delay in airing probably pushed it to a period when word of mouth wasn’t going to be great unless they executed everything perfectly. I don’t know if it actually sold worse, though; it was in steady decline well in advance of the anime, and we only have one non-charting volume from after it finally aired. Might have come down to the anime getting aired because it was already paid for.

I do wonder if it would have done better if they took the then-finished anime in late 2011 and started packaging episodes with 2000 yen LE volumes of the manga (which still released regularly in the months after the tragedy). But that’s just speculation.

I heard that the major manga magazines have a reputation for cancelling series that don’t sell well, even cancelling manga whose anime adaptations do poorly. Does this mean Arata is in trouble?

Fortunately (for it, anyway), WSS management is very heavy on seniority and very light on the kind of aggressive hit farming WSJ does. It’s inferior as a business plan, but it means I wouldn’t be surprised if Arata ran 5 more years.

Also, even before Shingeki aired, the manga was already a massive success, but the anime only brought sales into the stratosphere.

Finally:

>Gifu Dodo, Arata Kangatari, and Coppelion all seem like poorly timed adaptations, coming after a series declined from a clear peak figure.

Looks like Amagi Brilliant Park will have quite an uphill battle (as you already discussed in a previous post), but it looks like the odds against it are stacking up.

I’m realizing just now that it could be taken as “the anime and manga both did well” or “the manga was big way before it had a bandwagon in the west, it just got bigger afterwards”. The latter was my original intention.

Manga and light novel markets aren’t totally analogous, but these do underscore cases found in that market. There’s a big difference between Amagi and the other LN cases (C3, ImoIru) that should be noted; they declined with each subsequent volume in the lead-up to the anime, whereas the total between volumes 2 and 3 of Amagi was steady at 15k. Don’t know how significant that is, but it is a potentially notable wrinkle.

C3 and ImoIru? Could you elaborate on those two or at least link to your analysis of them (if there is one?) I only know that C3 was a flop (although it was apparently popular enough for its lead girl to be in ISML at least in 2012.

C3: https://animetics.files.wordpress.com/2014/01/c3.png

ImoIru (a bump, but one of the slightest I’ve seen): https://animetics.files.wordpress.com/2014/01/imoiru.png

I have only a very tangential knowledge of isml, but it seems to me it doesn’t take much to make it into the bracket, more so to get past the third round.

So this means the C3 anime failed to achieve its purpose? Because usually even flop anime can give a permanent boost to sales, but with C3, by the end, sales were actually worse than before the anime.

There’s always the caveat about potential long tail sales. But even then, given the series also ended soon after, any moderate boost it may have gotten there couldn’t play out particularly well. That’s one where they were likely banking on disk totals they didn’t get.

Oh yeah, how were the manga sales for Nichibros? I know that the manga was ended by the author, but it would be interesting to see if it ever got any boosts from the anime. And what about C3-bu and Mangirl?

If you want to see plots like this for any series that ran in 2011-2012 that has data available, just type “advertisments” into the site search bar. It’ll bring up the relevant pages. C3-bu/Mangirl never charted ever, so they’re pretty much icebergs that are 100% underwater.